Get the free what is the repo assignment determining the authority for repossession

Fill out, sign, and share forms from a single PDF platform

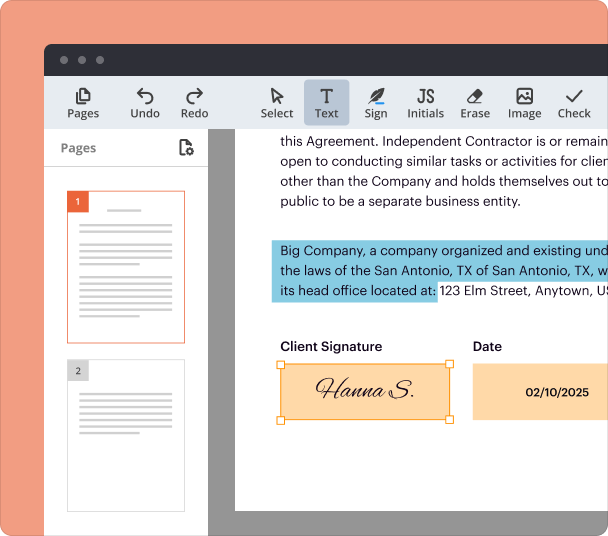

Edit and sign in one place

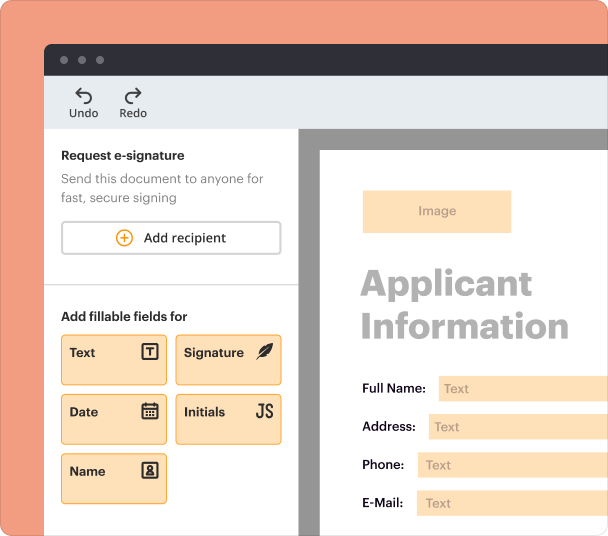

Create professional forms

Simplify data collection

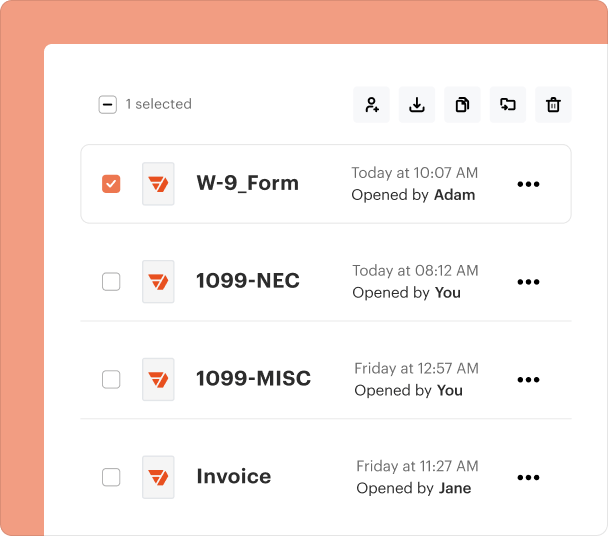

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Repo assignment order form guide

Filling out a repo assignment order form can be straightforward if you know the essential components and steps involved. This guide aims to help you understand how to navigate the complexities of this critical document in the repossession process.

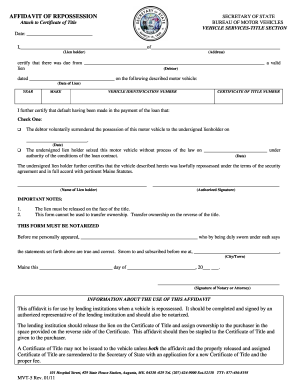

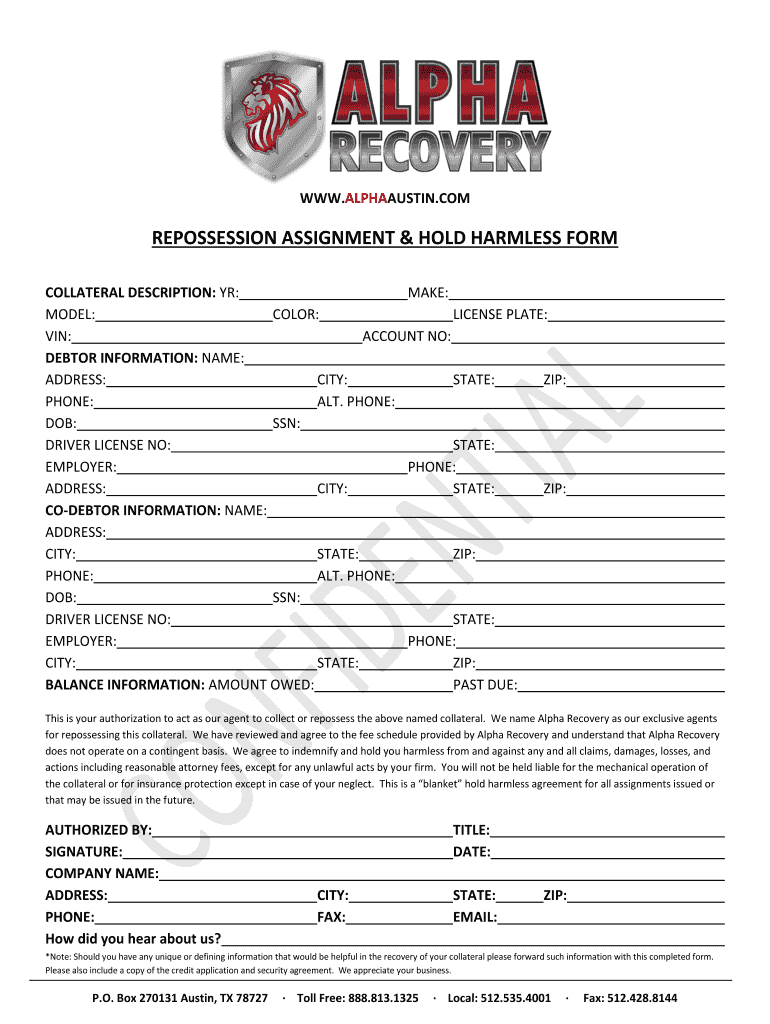

What is the repo assignment order form?

A repo assignment order form is a legal document used to facilitate the repossession of property. It serves as a formal request allowing a lender or creditor to reclaim property when a debtor defaults on their agreement. Understanding this document is crucial for both creditors and debtors.

-

This form is essential in repossession as it outlines the authority transferred from the creditor to the repossession agent.

-

The form indicates the legal basis for reclaiming assets and helps in ensuring compliance with state laws and regulations.

What are the key components of the repo assignment order form?

A well-structured repo assignment order form contains several critical sections that ensure clarity and compliance.

-

Details the item being repossessed, providing specifics such as make, model, and identification numbers.

-

Contains important data about the debtor, including contact information and any relevant identification numbers.

-

If applicable, this section includes data about any co-debtors, ensuring all parties involved in the agreement are identified.

-

States the remaining balance owed by the debtor, crucial for determining the authority for repossession.

-

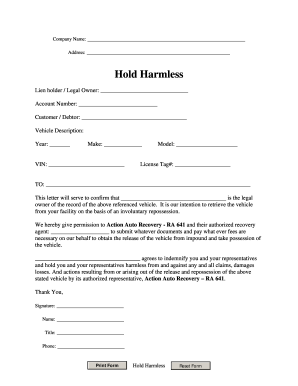

This is a legal agreement that protects the repossession agent from liability during the repossession process.

How do you fill out the repo assignment order form?

Filling out the repo assignment order form requires attention to detail to avoid common pitfalls that could lead to delays or legal issues.

-

Begin by entering the debtor's details, followed by the collateral description, and continue filling in all required fields carefully.

-

Double-check the information entered, especially identification numbers and signatures, as errors can lead to complications in the repossession process.

How can pdfFiller help in managing repossession orders?

pdfFiller offers powerful tools to manage your repo assignment order form efficiently. With its user-friendly interface, you can easily edit, sign, and collaborate on the document.

-

Use pdfFiller's editing tools to customize the form as needed while ensuring compliance with legal standards.

-

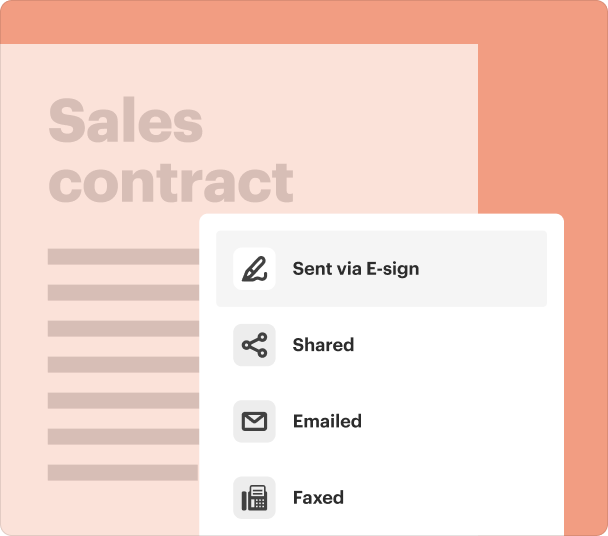

Utilize eSign features to ensure that all parties have legally signed the document without the hassle of physical paperwork.

-

Work with team members seamlessly on pdfFiller, allowing multiple users to contribute to the document simultaneously.

What are state and legal compliance factors to consider?

Understanding state regulations is vital for anyone involved in the repossession process to avoid potential penalties.

-

Each state has different regulations governing repossession, so it's essential to consult local laws.

-

Ensure that all sections of the repo assignment order form are completed correctly and keep copies for your records to meet compliance standards.

How to contact support for assistance?

When issues arise with your repo assignment order form, reaching out for support can make the process smoother.

-

Contact pdfFiller support through email, phone, or live chat for prompt assistance.

-

Clearly describe your issue, including specific details about your repo assignment order form to receive the best possible help.

What are common terms used in repossession orders?

Familiarizing yourself with the terminology used in repo assignment order forms can help reduce confusion.

-

Understanding terms like 'repossession', 'collateral', and 'debtor' will provide clarity when navigating legal documents.

-

Recognizing these terms is essential for successfully completing and managing repo assignments.

Frequently Asked Questions about repo order template form

What should I do if I filled out the repo assignment order form incorrectly?

If you filled out the form incorrectly, it’s crucial to correct any errors immediately. This may involve redrafting the document or making edits if you are using an online tool such as pdfFiller.

How can I access the repo assignment order form online?

You can access the repo assignment order form online through pdfFiller's platform, which offers templates and editing tools to help you create and manage the document efficiently.

Who is responsible for filling out the repo assignment order form?

The creditor or lender is typically responsible for filling out the repo assignment order form, detailing the reasons for repossession and the associated debtor information.

Is there a specific format for the repo assignment order form?

While the general information is consistent, the specific format can vary by state or lender. It’s essential to refer to local regulations to ensure compliance.

Can I use electronic signatures on the repo assignment order form?

Yes, electronic signatures are legally accepted in many jurisdictions. Using pdfFiller, you can easily eSign your forms, ensuring they are valid and legally binding.

pdfFiller scores top ratings on review platforms